In a of previous article I wrote about understanding cryptocurrencies and what to look for when investing as well as understanding buy/sell walls on exchanges. This still leaves the question, what should I look for when choosing a coin to day trade?

Now I need to pause things here and say, I am not a qualified financial advisor. The information below is purely my lessons, observations and experience in the crypto world that I want to pass on. If you decide to invest in cryptocurrency, only invest what you are willing to lose. Do your own research and learn from as many people as you can to gain a well rounded understanding of cryptocurrency trading.

You must have a hard backbone to weather the volatility of this market. I’ve lost thousands of dollars in hours, but by holding and staying strong it comes back up.

Due to this volatility of the crypto world you can make profits off almost any coin on the market if you have enough experience. But even I don’t have that amount of experience required. As such I’ll be tackling the idea of trading coins with a lower risk involved and how to ensure you can always make some profits.

Due to this volatility of the crypto world you can make profits off almost any coin on the market if you have enough experience. But even I don’t have that amount of experience required. As such I’ll be tackling the idea of trading coins with a lower risk involved and how to ensure you can always make some profits.

Purpose

The first thing to do, which I also mention in my previous articles is to figure out what your goal or purpose is for day trading? Is it to make 5% profits every month and have little risk, or is it to double your money each month and laugh in the face of risk? Or maybe it is to build up a good base to start spreading your portfolio into other coins? Regardless of the reason, it is important to identify it and remember it. This will give you direction and a sound base for your decision making. Without it you will find yourself floating in the vast ocean of price movements, being knocked to and fro by every rise and dip. You need an anchor point and this will be your purpose.

Once you have made clear your goals in day trading, I would also suggest you figure out how fast you want to get there (if you haven’t already). This will help in determining your risk profile. If you want to

double your money in one week (Probably a little unrealistic) then you can throw risk out the window and go crazy with your trades… might not be overly profitable, but if you want a slow and steady profit increase then you can relax and settle in for a low risk coin with low risk trades.

The next few steps Can come in any order but I will give the reasons I have for suggesting the order below.

The first thing to do, which I also mention in my previous articles is to figure out what your goal or purpose is for day trading? Is it to make 5% profits every month and have little risk, or is it to double your money each month and laugh in the face of risk? Or maybe it is to build up a good base to start spreading your portfolio into other coins? Regardless of the reason, it is important to identify it and remember it. This will give you direction and a sound base for your decision making. Without it you will find yourself floating in the vast ocean of price movements, being knocked to and fro by every rise and dip. You need an anchor point and this will be your purpose.

Once you have made clear your goals in day trading, I would also suggest you figure out how fast you want to get there (if you haven’t already). This will help in determining your risk profile. If you want to

double your money in one week (Probably a little unrealistic) then you can throw risk out the window and go crazy with your trades… might not be overly profitable, but if you want a slow and steady profit increase then you can relax and settle in for a low risk coin with low risk trades.

The next few steps Can come in any order but I will give the reasons I have for suggesting the order below.

Exchange

One of the first things to look for after deciding on your purpose, even before you have selected your coin, is to decide on an exchange you want to use. There would be 3 main aspects that you want to consider when choosing an exchange.

Firstly, ensure it has a wide variety of popular coins and has high trading volume. This ensures there will be sufficient activity on the exchange for trading purposes. A typically well established exchange should be trading at least $200M at a very minimum. Ideally you would be looking at one which has $0.5–1+M trading volume every 24 hours. I currently do my trading with Binance which has traded $1.9M in the last 24 hours and has almost 250 different trading pairs.

One of the first things to look for after deciding on your purpose, even before you have selected your coin, is to decide on an exchange you want to use. There would be 3 main aspects that you want to consider when choosing an exchange.

Firstly, ensure it has a wide variety of popular coins and has high trading volume. This ensures there will be sufficient activity on the exchange for trading purposes. A typically well established exchange should be trading at least $200M at a very minimum. Ideally you would be looking at one which has $0.5–1+M trading volume every 24 hours. I currently do my trading with Binance which has traded $1.9M in the last 24 hours and has almost 250 different trading pairs.

The second thing to look at with an exchange is the trading fees. Sometimes exchanges will have different fees with different criteria for the same exchange. For example, with Binance they have a 0.1% fee for trades if you pay with the local coin being traded; but if you pay with Binance Coins then they will half the fees for the first year, resulting in only 0.05% fees per trade. Other exchanges will often vary the fees depending on if you are a ‘maker’ or ‘taker’. A ‘maker’ is someone who puts in a trade request that is not fulfilled straightaway, hence they are ‘making’ part of the buy/sell orders. A ‘taker’ is someone who is putting in a trade request that is fulfilling someone else’s trade order, hence you are ‘taking’ away one of the buy/sell orders. Often the fees are higher for ‘takers’ compared to ‘makers’. When looking at fees of 01%, 0.25%, 0.5% etc you may think this is miniscule and doesn’t really matter. I can’t emphasize enough that it does matter if you plan on doing long term trading. If you are a profitable trader starting with $100 and make 2.5% profit a day and we compound this over 1 year of trading, then having to pay 0.5% fees per day assuming you do one trade a day will reduce your profit by hundreds of thousands of dollars. This sounds crazy but you do the math and it comes out the same. Figure out how often you will be doing trades, i.e. daily, bi-daily, weekly etc. and work out which strategy on which exchange will reduce your fees to a level you are comfortable with.

The third thing to look at is how easy it is to withdraw funds from this particular exchange. Check fees, criteria, verification, limits etc. Once you have made profits you will want to be able to withdraw them without having problems or paying large amounts of it in fees.

The third thing to look at is how easy it is to withdraw funds from this particular exchange. Check fees, criteria, verification, limits etc. Once you have made profits you will want to be able to withdraw them without having problems or paying large amounts of it in fees.

The Coin

The next thing I would suggest you look at is the price of the coin and trading volume. These aspects are good to look at separately as well as together. The price can be related to your risk profile. I say this very loosely, but is a small indicator. Generally speaking, if a coin is very cheap then there could be more risk involved for two reasons. Firstly, the low price could be an indication of low community trust or poor project management/communication. This creates low demand and thus lowers the value of the coin. The second reason is that if a coin is valued at $0.02 and it drops by only 1c then your investment will be cut in half just like that.

The next thing I would suggest you look at is the price of the coin and trading volume. These aspects are good to look at separately as well as together. The price can be related to your risk profile. I say this very loosely, but is a small indicator. Generally speaking, if a coin is very cheap then there could be more risk involved for two reasons. Firstly, the low price could be an indication of low community trust or poor project management/communication. This creates low demand and thus lowers the value of the coin. The second reason is that if a coin is valued at $0.02 and it drops by only 1c then your investment will be cut in half just like that.

I’m not saying don’t invest in cheap coins, but just be aware that there are more risks involved. On the flip side, there are more profits involved. After all, if you buy at $0.01, you only need a 1c increase to double your money.

In regards to the trading volume of a coin, the concept is similar to that of an exchange. You want something that everyone is buying/selling as it shows a degree of community confidence, as well as liquidity — the ability to realize your profits quickly or move them into money you can use.

In regards to the trading volume of a coin, the concept is similar to that of an exchange. You want something that everyone is buying/selling as it shows a degree of community confidence, as well as liquidity — the ability to realize your profits quickly or move them into money you can use.

One aspect NOT to get fooled with is by seeing a coin with a high trading volume, but then you see it is really expensive and think it is not liquid. For example, a coin has a trading volume of $1,000,000, but you see it costs $1,000 per coin. This means only 1000 coins are traded over the 24hr period. Compare this to a coin with the same trading volume but a coin cost of $1 meaning 1,000,000 coins are trading every day. This should not affect your decision primarily because the amount you will be trading stays the same in $ value, not in the number of coins. Your $100 in the expensive coin, is still only worth $100 in the cheap coin. I’m currently trading KNC/ETH which has a trading volume of $1.7M and a price of $3.75

Once you have a handful of coins narrowed down now based upon the above criteria (of course make sure the coin is traded on your selected exchange in the trading pair you want) then it is time to start looking at things in a bit more detail. This is where you look at the project itself, the age of the coin, the team behind it, the community engagement etc. This helps you understand the longevity of the coin and if the coin’s overall value is likely to increase. Looking at what is called the ‘Roadmap’ of a coin normally will identify key dates along a timeline in which project updates or releases will occur. This can be good times to just hold rather than trade as these can bump the price up a bit. But remember every sudden price increase is always due for a ‘correction’ I will go into this a bit more in a later article.

Patterns

Now that we have a coin selected, we can start watching the trading patterns. I would suggest you look at this for a few weeks to get an idea of how it reacts to certain times of the day and week, and how it reacts to news etc. This will help you maximize your trades and limit the sudden losses from bad trades which are predictable.

Now that we have a coin selected, we can start watching the trading patterns. I would suggest you look at this for a few weeks to get an idea of how it reacts to certain times of the day and week, and how it reacts to news etc. This will help you maximize your trades and limit the sudden losses from bad trades which are predictable.

For example, With the KNC/ETH pair, there is often positive activity at 9am and 7pm AEST and often Sunday/Monday has poor activity. Also when there are large announcements made by KNC on twitter, it takes about 15–20 minutes before the market reacts. I won’t provide evidence of this because there is too much to go into in this article, but this should give you an idea of the sort of patterns you are looking for. If the coin is relatively new, then there will be less obvious patterns compared to an older coin.

Conclusion

As you start to day trade, read the news, look at articles online, subscribe to the coin’s newsletter, register on twitter, get involved in forums. Do everything you can to get information first to benefit from the market swings.

My last pearl of wisdom is this. Don’t try and get the absolute best profit and each rise and dip. The best traders will always take what profits they can and small but steady add up very quickly.

In Part Two I go into more depth about how to read charts, trends to look for and trading strategies. But the first thing to do is to get started, even with a few dollars, just get started.

As you start to day trade, read the news, look at articles online, subscribe to the coin’s newsletter, register on twitter, get involved in forums. Do everything you can to get information first to benefit from the market swings.

My last pearl of wisdom is this. Don’t try and get the absolute best profit and each rise and dip. The best traders will always take what profits they can and small but steady add up very quickly.

In Part Two I go into more depth about how to read charts, trends to look for and trading strategies. But the first thing to do is to get started, even with a few dollars, just get started.

Joshua (Mappo) has been investing and trading in fiat currencies since 2013. He has recently moved into the crypto world spreading his portfolio over long term coin investments, ICOs and day trading.

Join now at BInance.com

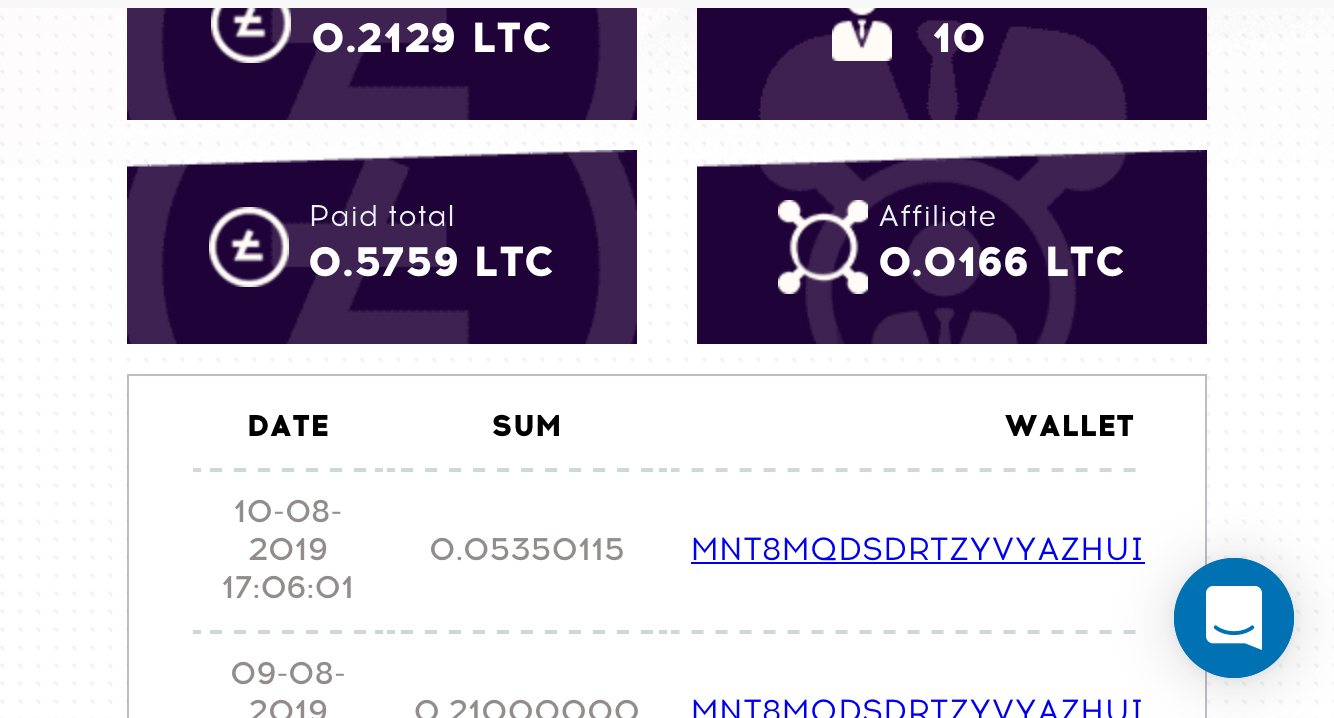

Payment System: Instant

Payment System: Instant